All Categories

Featured

Table of Contents

nfinite banking is a financial strategy that empowers you to take control of your finances using the cash value of a whole life insurance policy. By becoming your own banker, you can leverage the cash value to fund large expenses, invest in business opportunities, or handle emergencies—all while your money continues to grow tax-free. For business owners, infinite banking is an invaluable tool for maintaining financial independence and flexibility.

Whole life insurance policies designed for infinite banking offer stability and predictability, ensuring steady cash value growth over time. whole life insurance for cash value growth brokers. Policies with living benefits further enhance their appeal, offering access to funds for critical illnesses or other urgent needs. Whether you’re looking to finance major purchases, grow your business, or achieve financial independence, infinite banking adapts to your goals while providing long-term security

This concept is especially beneficial for individuals and families seeking flexible financial solutions or business owners aiming to optimize their cash flow. Learn more about how infinite banking can transform your financial future. Schedule a free consultation today and take the first step toward achieving complete financial control.

That usually makes them an extra affordable alternative for life insurance coverage. Some term policies might not keep the costs and survivor benefit the same over time. You don't desire to mistakenly believe you're buying level term insurance coverage and afterwards have your fatality advantage modification later. Many individuals get life insurance policy coverage to help economically protect their loved ones in case of their unanticipated fatality.

Or you may have the option to convert your existing term protection into an irreversible policy that lasts the remainder of your life. Various life insurance plans have possible advantages and drawbacks, so it's crucial to understand each before you make a decision to purchase a plan.

As long as you pay the costs, your beneficiaries will certainly get the fatality benefit if you die while covered. That said, it's important to note that a lot of policies are contestable for 2 years which implies protection could be rescinded on fatality, should a misrepresentation be discovered in the application. Policies that are not contestable typically have a rated survivor benefit.

Costs are normally lower than entire life plans. You're not secured right into an agreement for the remainder of your life.

And you can't cash out your plan during its term, so you will not get any financial advantage from your past coverage. Just like various other kinds of life insurance, the price of a degree term plan relies on your age, insurance coverage requirements, employment, way of living and wellness. Commonly, you'll discover extra economical insurance coverage if you're younger, healthier and less risky to guarantee.

Level Premium Term Life Insurance Policies

Given that degree term costs stay the exact same for the duration of protection, you'll recognize precisely just how much you'll pay each time. Degree term insurance coverage also has some flexibility, allowing you to personalize your policy with additional functions.

You might have to satisfy particular problems and qualifications for your insurance provider to pass this cyclist. There likewise could be an age or time limitation on the insurance coverage.

The survivor benefit is typically smaller, and insurance coverage generally lasts until your child transforms 18 or 25. This biker might be a more cost-efficient method to assist guarantee your youngsters are covered as motorcyclists can usually cover several dependents at once. As soon as your youngster ages out of this protection, it might be possible to convert the rider right into a new plan.

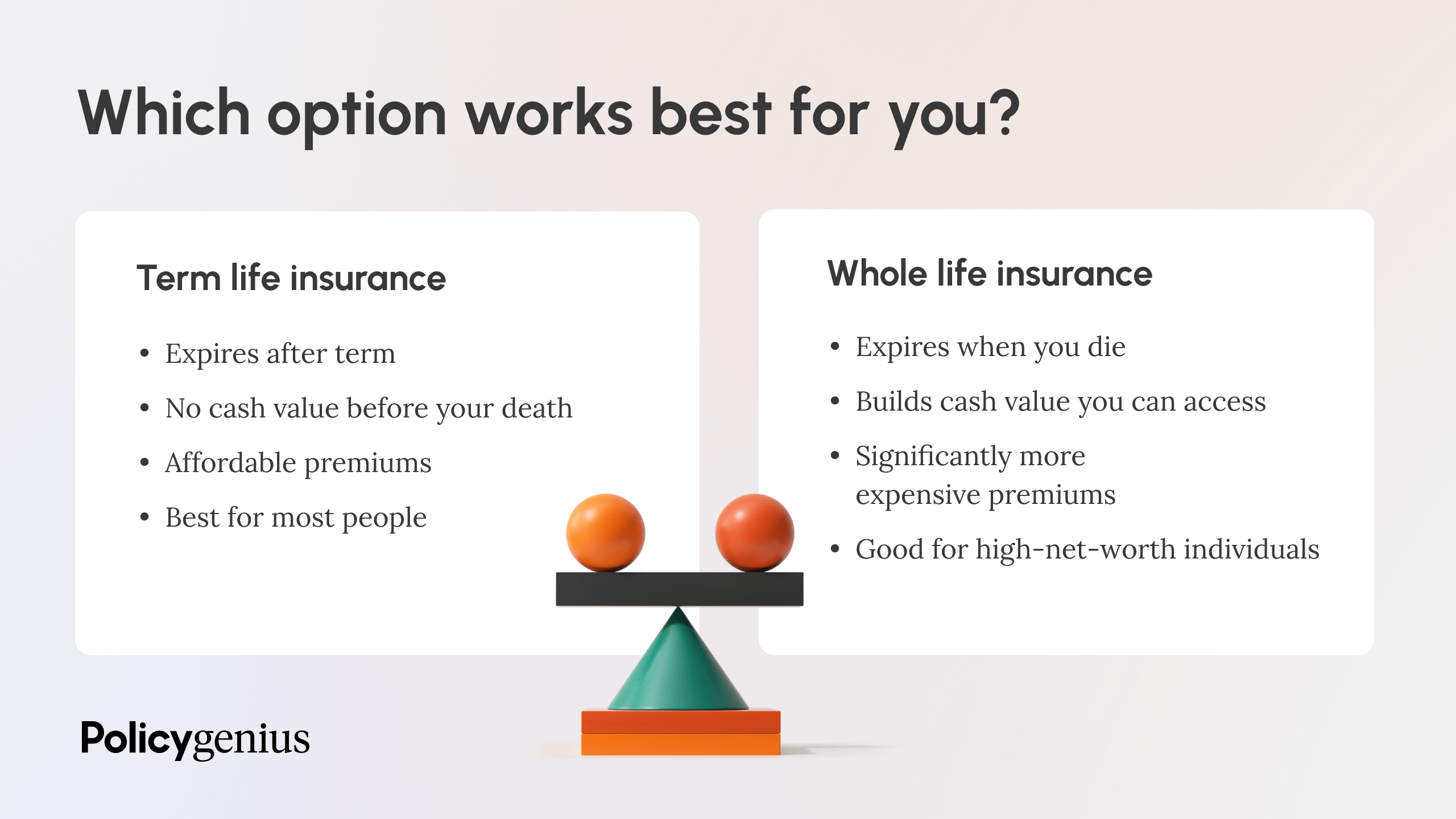

The most typical type of irreversible life insurance is whole life insurance, however it has some crucial distinctions compared to level term protection. Below's a fundamental summary of what to think about when comparing term vs.

Secure Decreasing Term Life Insurance

Whole life insurance lasts for life, while term coverage lasts for a specific periodCertain The costs for term life insurance coverage are typically reduced than entire life insurance coverage.

One of the main functions of level term coverage is that your costs and your fatality advantage don't alter. You may have coverage that begins with a fatality advantage of $10,000, which can cover a home mortgage, and then each year, the fatality advantage will reduce by a collection quantity or percent.

Because of this, it's frequently an extra cost effective kind of level term insurance coverage. You may have life insurance policy with your employer, yet it might not be adequate life insurance policy for your requirements. The initial step when getting a policy is identifying just how much life insurance you need. Take into consideration variables such as: Age Family members dimension and ages Employment status Revenue Financial obligation Way of living Expected final expenditures A life insurance policy calculator can assist establish just how much you need to start.

After choosing a policy, complete the application. For the underwriting process, you might have to provide general personal, wellness, lifestyle and work information. Your insurance firm will identify if you are insurable and the risk you might offer to them, which is mirrored in your premium costs. If you're accepted, authorize the paperwork and pay your initial premium.

Guaranteed What Is Direct Term Life Insurance

Finally, consider organizing time annually to examine your plan. You might wish to upgrade your beneficiary details if you have actually had any kind of significant life adjustments, such as a marriage, birth or separation. Life insurance can sometimes feel difficult. You don't have to go it alone. As you discover your options, consider discussing your needs, desires and concerns with a financial expert.

No, degree term life insurance coverage does not have cash money value. Some life insurance policy policies have an investment function that enables you to build cash worth gradually. A section of your premium payments is established apart and can make interest gradually, which expands tax-deferred throughout the life of your coverage.

These policies are usually considerably a lot more expensive than term protection. If you get to completion of your plan and are still alive, the insurance coverage ends. However, you have some options if you still desire some life insurance coverage. You can: If you're 65 and your coverage has actually run out, for instance, you may wish to buy a new 10-year level term life insurance policy.

Effective Level Term Life Insurance

You may have the ability to transform your term coverage into an entire life policy that will last for the remainder of your life. Many kinds of degree term policies are exchangeable. That implies, at the end of your insurance coverage, you can convert some or all of your policy to entire life insurance coverage.

Degree term life insurance policy is a policy that lasts a set term normally between 10 and thirty years and includes a degree fatality benefit and degree premiums that stay the same for the entire time the policy holds. This implies you'll know exactly just how much your repayments are and when you'll need to make them, allowing you to budget as necessary.

Level term can be a great alternative if you're wanting to buy life insurance policy protection for the initial time. According to LIMRA's 2023 Insurance coverage Barometer Research Study, 30% of all grownups in the united state need life insurance policy and do not have any kind of policy yet. Level term life is predictable and budget-friendly, that makes it among the most popular types of life insurance policy.

Latest Posts

Funeral Insurance For Seniors

Insurance For Death Expenses

Burial Insurance No Medical Exam