All Categories

Featured

Table of Contents

Home mortgage life insurance gives near-universal insurance coverage with very little underwriting. There is usually no medical exam or blood sample needed and can be a valuable insurance coverage choice for any home owner with severe preexisting medical problems which, would stop them from buying typical life insurance coverage. Various other advantages include: With a mortgage life insurance policy policy in location, successors won't have to stress or wonder what could occur to the family home.

With the home mortgage paid off, the household will always belong to live, given they can pay for the real estate tax and insurance coverage annually. loan insurance company.

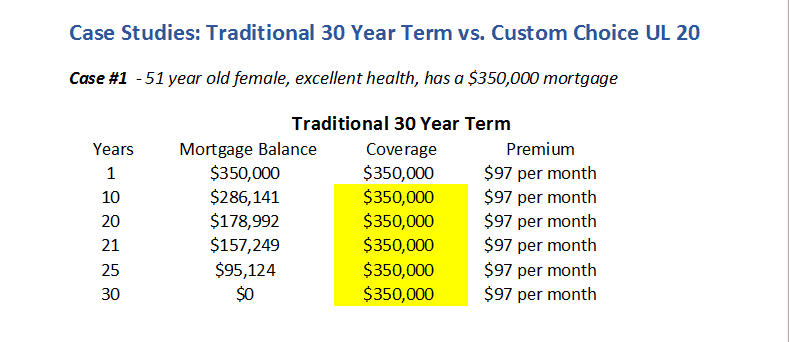

There are a few different kinds of mortgage defense insurance coverage, these include:: as you pay more off your mortgage, the amount that the policy covers reduces in line with the outstanding balance of your home loan. It is the most common and the most inexpensive type of home mortgage protection - do you have to have life insurance for a mortgage.: the quantity insured and the costs you pay continues to be level

This will repay the home mortgage and any kind of remaining equilibrium will most likely to your estate.: if you want to, you can include severe health problem cover to your mortgage protection plan. This indicates your mortgage will certainly be removed not just if you die, yet additionally if you are identified with a severe illness that is covered by your policy.

What Is Mortgage Insurance On A Home Loan

In addition, if there is a balance continuing to be after the home loan is cleared, this will most likely to your estate. If you change your home loan, there are several things to consider, relying on whether you are covering up or expanding your home loan, switching, or paying the home mortgage off early. If you are covering up your home mortgage, you need to make sure that your plan fulfills the new value of your mortgage.

Contrast the expenses and advantages of both options (mortgage insurance vs life insurance cbc). It may be less expensive to keep your initial mortgage security plan and after that acquire a 2nd policy for the top-up quantity. Whether you are covering up your home mortgage or expanding the term and need to get a new plan, you may find that your premium is more than the last time you obtained cover

Home Loan Credit Life Insurance

When changing your mortgage, you can appoint your mortgage security to the new loan provider. The costs and degree of cover will coincide as prior to if the amount you obtain, and the term of your home mortgage does not alter. If you have a policy with your lending institution's group plan, your lender will cancel the plan when you change your mortgage.

In California, home loan security insurance covers the whole impressive equilibrium of your loan. The fatality benefit is an amount equal to the equilibrium of your home mortgage at the time of your passing.

Life Insurance To Cover Mortgage

It's crucial to understand that the fatality benefit is given straight to your creditor, not your loved ones. This assures that the continuing to be debt is paid completely and that your liked ones are saved the monetary pressure. Mortgage security insurance can additionally provide temporary protection if you come to be impaired for an extensive duration (generally six months to a year).

There are numerous advantages to getting a home mortgage defense insurance coverage in California. Some of the leading benefits include: Assured approval: Even if you're in inadequate health or operate in an unsafe career, there is assured approval with no medical examinations or lab tests. The very same isn't real permanently insurance policy.

Impairment security: As stated over, some MPI policies make a couple of home loan repayments if you end up being disabled and can not bring in the exact same earnings you were accustomed to. It is essential to keep in mind that MPI, PMI, and MIP are all various types of insurance coverage. Mortgage security insurance (MPI) is created to settle a home loan in situation of your death.

Mortgage Life Insurance Explained

You can even use online in mins and have your plan in location within the very same day. To learn more about obtaining MPI insurance coverage for your home lending, get in touch with Pronto Insurance today! Our educated representatives are here to answer any concerns you might have and supply more help.

It is recommended to contrast quotes from different insurers to discover the ideal rate and insurance coverage for your needs. MPI uses a number of benefits, such as comfort and streamlined credentials procedures. Nonetheless, it has some constraints. The fatality advantage is straight paid to the lending institution, which restricts versatility. Additionally, the benefit quantity decreases with time, and MPI can be much more expensive than typical term life insurance coverage plans.

What Is Mortgage Insurance And Do I Need It

Go into fundamental information about on your own and your mortgage, and we'll contrast rates from different insurance providers. We'll also reveal you how much protection you require to safeguard your home mortgage. So begin today and provide yourself and your household the assurance that comes with knowing you're protected. At The Annuity Professional, we comprehend homeowners' core trouble: guaranteeing their family members can preserve their home in the occasion of their fatality.

The primary benefit right here is clarity and self-confidence in your decision, understanding you have a strategy that fits your needs. As soon as you accept the plan, we'll take care of all the documentation and setup, making sure a smooth execution process. The positive outcome is the satisfaction that includes recognizing your family is shielded and your home is protected, regardless of what happens.

Specialist Advice: Assistance from skilled professionals in insurance and annuities. Hassle-Free Configuration: We take care of all the documentation and application. Cost-efficient Solutions: Locating the finest coverage at the most affordable feasible cost.: MPI specifically covers your mortgage, giving an extra layer of protection.: We work to find the most economical solutions tailored to your spending plan.

They can offer details on the coverage and benefits that you have. Usually, a healthy person can anticipate to pay around $50 to $100 per month for home mortgage life insurance. It's advised to get a customized home mortgage life insurance coverage quote to get an exact estimate based on individual conditions.

Latest Posts

Funeral Insurance For Seniors

Insurance For Death Expenses

Burial Insurance No Medical Exam