All Categories

Featured

Table of Contents

Level term life insurance coverage is a policy that lasts a set term generally in between 10 and 30 years and features a degree death advantage and level costs that remain the exact same for the whole time the policy holds. This suggests you'll understand precisely just how much your settlements are and when you'll have to make them, permitting you to budget plan appropriately.

Level term can be a fantastic alternative if you're wanting to purchase life insurance policy protection for the initial time. According to LIMRA's 2023 Insurance Barometer Research, 30% of all adults in the united state requirement life insurance policy and do not have any kind of kind of plan yet. Level term life is predictable and affordable, that makes it one of one of the most prominent sorts of life insurance policy.

A 30-year-old man with a comparable profile can expect to pay $29 each month for the same protection. AgeGender$250,000 protection amount$500,000 insurance coverage amount$1 million protection amount20Female$15$23$34Male$19$29$4830Female$15$23$37Male$18$29$4940Female$22$35$61Male$25$43$7550Female$44$78$139Male$57$102$18860Female$108$194$355Male$149$268$500 Collapse table Method: Average monthly rates are determined for male and female non-smokers in a Preferred health classification obtaining a 20-year $250,000, $500,000, or $1,000,000 term life insurance policy plan.

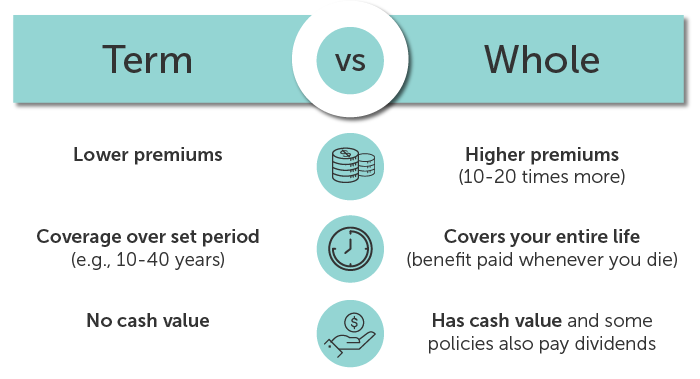

Prices may differ by insurance company, term, protection quantity, health course, and state. Not all policies are available in all states. Price illustration legitimate as of 09/01/2024. It's the cheapest type of life insurance for most individuals. Degree term life is a lot more affordable than a similar entire life insurance coverage plan. It's simple to take care of.

It enables you to spending plan and plan for the future. You can conveniently factor your life insurance policy right into your spending plan due to the fact that the costs never transform. You can prepare for the future equally as conveniently since you recognize exactly how much money your liked ones will get in case of your absence.

What is Term Life Insurance With Level Premiums? Explained in Simple Terms?

In these cases, you'll normally have to go with a brand-new application process to get a far better rate. If you still need insurance coverage by the time your degree term life plan nears the expiry date, you have a few options.

A lot of degree term life insurance policy policies come with the option to renew coverage on an annual basis after the initial term ends. The price of your policy will certainly be based upon your existing age and it'll boost annually. This could be a great alternative if you only require to expand your coverage for a couple of years otherwise, it can obtain pricey pretty rapidly.

Degree term life insurance policy is just one of the least expensive coverage choices on the marketplace because it provides standard protection in the kind of fatality advantage and only lasts for a collection period of time. At the end of the term, it runs out. Whole life insurance policy, on the various other hand, is considerably more expensive than level term life since it does not run out and comes with a cash worth function.

Not all policies are offered in all states. Degree term is a wonderful life insurance coverage choice for the majority of individuals, but depending on your insurance coverage requirements and individual scenario, it could not be the best fit for you.

Annual eco-friendly term life insurance has a term of only one year and can be renewed every year. Annual sustainable term life costs are originally less than level term life premiums, but prices rise each time you renew. This can be a great choice if you, for instance, have simply stop smoking and require to wait 2 or three years to request a degree term policy and be qualified for a reduced rate.

, your fatality benefit payment will reduce over time, however your repayments will stay the exact same. On the various other hand, you'll pay even more ahead of time for less coverage with a boosting term life policy than with a degree term life plan. If you're not certain which kind of plan is best for you, functioning with an independent broker can assist.

As soon as you've chosen that degree term is right for you, the next step is to buy your policy. Right here's just how to do it. Calculate just how much life insurance coverage you require Your insurance coverage amount must provide for your family members's lasting monetary demands, including the loss of your revenue in case of your fatality, in addition to financial debts and day-to-day expenses.

The most prominent kind is currently 20-year term. Most companies will not sell term insurance to a candidate for a term that finishes past his or her 80th birthday. If a policy is "sustainable," that suggests it continues effective for an extra term or terms, as much as a specified age, also if the wellness of the insured (or other aspects) would create him or her to be denied if he or she applied for a brand-new life insurance policy policy.

Costs for 5-year renewable term can be degree for 5 years, after that to a new price mirroring the new age of the insured, and so on every 5 years. Some longer term plans will certainly assure that the costs will not raise during the term; others don't make that guarantee, allowing the insurer to increase the price throughout the plan's term.

What is Level Term Vs Decreasing Term Life Insurance? Important Insights?

This indicates that the policy's proprietor can change it right into a permanent kind of life insurance without extra evidence of insurability. In a lot of types of term insurance policy, consisting of homeowners and auto insurance policy, if you haven't had a claim under the plan by the time it runs out, you get no refund of the premium.

Some term life insurance consumers have been unhappy at this outcome, so some insurance companies have developed term life with a "return of costs" attribute. The premiums for the insurance with this feature are frequently dramatically more than for policies without it, and they usually require that you maintain the plan effective to its term or else you surrender the return of premium advantage.

Degree term life insurance policy premiums and fatality advantages stay consistent throughout the plan term. Level term life insurance coverage is normally a lot more economical as it doesn't develop cash worth.

While the names usually are utilized reciprocally, degree term protection has some important differences: the costs and survivor benefit remain the exact same for the duration of protection. Degree term is a life insurance policy plan where the life insurance policy costs and death benefit stay the same throughout of protection.

Latest Posts

Funeral Insurance For Seniors

Insurance For Death Expenses

Burial Insurance No Medical Exam